Open a Synchrony Bank savings account? Sounds boring, right? Wrong! Picture this: you, sipping a mango lassi, effortlessly opening a high-yield account from your hammock. No stuffy bank branches, no grumpy tellers. Just you, your phone, and a future brimming with extra moolah.

This isn’t your grandma’s savings account; we’re talking sleek online banking, sweet interest rates, and surprisingly simple steps to financial freedom. Let’s dive in and see how easy it really is to make your money work for you.

This guide will walk you through the entire process of opening a Synchrony Bank savings account, from the initial application to managing your funds. We’ll cover everything from the required documents and the various account features to the security measures in place and the customer support options available. We’ll even compare Synchrony Bank’s offerings to other banks, so you can make an informed decision.

Get ready to unlock your financial potential!

Opening a Synchrony Bank Savings Account: Open A Synchrony Bank Savings Account

This article provides a comprehensive guide to opening and managing a Synchrony Bank savings account. We will cover the account opening process, features and benefits, account management, security, eligibility requirements, and a realistic example of a new customer’s experience.

Account Opening Process

Opening a Synchrony Bank savings account can be done online or potentially in-person, though in-person options may be limited. The online process is generally faster and more convenient. Specific requirements may vary, so always refer to Synchrony Bank’s official website for the most up-to-date information.

Online Account Opening: The online process typically involves visiting the Synchrony Bank website, locating the savings account application, completing the application form with personal and financial information, and verifying your identity. Required documentation may include a valid government-issued ID and Social Security number. After successful verification, you can fund your account.

Mobile App Account Opening (If Applicable): If Synchrony Bank offers a mobile app for account opening, the process would likely mirror the online process, requiring similar documentation and information. The app may offer a streamlined experience, but the requirements would remain consistent with the online method.

Comparison of Online and In-Person Processes: Online account opening is generally faster than in-person methods, often allowing for immediate account activation. In-person processes might require scheduling an appointment and providing physical documentation, leading to a longer processing time. The required information is largely the same for both methods, but in-person options might involve additional steps for identity verification.

Account Features and Benefits

Source: wallethacks.com

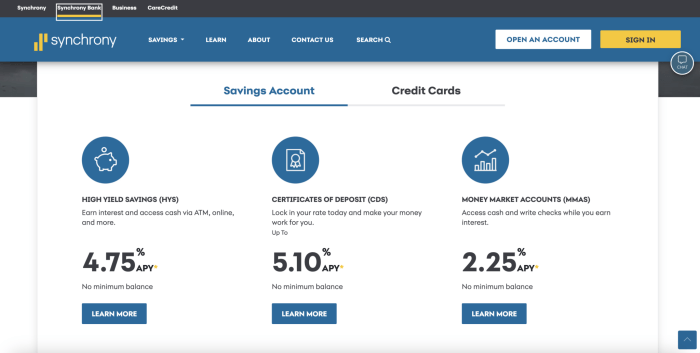

Synchrony Bank savings accounts offer various features and benefits to attract customers. These features can vary over time, so it is crucial to check the current offerings on the official website.

Interest Rates: Synchrony Bank typically offers competitive interest rates on its savings accounts. These rates may be tiered, meaning higher balances earn a higher interest rate. Specific rates are subject to change based on market conditions.

Account Fees: Synchrony Bank savings accounts may have associated fees. These could include monthly maintenance fees or transaction fees, depending on the specific account type. It is crucial to understand all applicable fees before opening an account.

Yo, thinking about opening a Synchrony Bank savings account? Pretty chill, right? But hey, if you’re moving and need to update your info with other banks, check out how to change address cit bank – it’s a similar process. Then, get back to focusing on that sweet Synchrony savings account! Easy peasy, lemon squeezy.

Bonus Interest Promotions: Synchrony Bank may occasionally offer bonus interest promotions or special offers to new customers, such as higher introductory interest rates or cash bonuses for opening an account. These promotions are usually temporary and have specific eligibility requirements.

Comparison with Similar Banks:

| Feature | Synchrony Bank | Bank A | Bank B |

|---|---|---|---|

| Interest Rate | Variable, tiered | Variable, tiered | Fixed |

| Monthly Fee | Potentially applicable | None | $5 |

| Minimum Balance | Potentially applicable | $100 | $500 |

| Online Access | Yes | Yes | Yes |

Note: The data in this table is for illustrative purposes only and may not reflect current offerings. Always check the bank’s official website for the most up-to-date information.

Account Management and Access, Open a synchrony bank savings account

Managing your Synchrony Bank savings account is straightforward and can be done through various channels. The bank typically provides multiple convenient access options.

Access Methods: You can access and manage your account through online banking, a mobile app (if available), and phone banking. Online banking generally offers the most comprehensive features.

Fund Transfers: Transferring funds into and out of your savings account is typically easy using online banking, the mobile app, or phone banking. You can transfer funds between your Synchrony Bank accounts or to external accounts at other financial institutions.

Automatic Savings Transfers: Setting up automatic savings transfers or recurring deposits is often a feature provided through online banking. This allows for regular contributions to your savings account without manual intervention.

Online Banking Features:

- Account balance viewing

- Transaction history

- Fund transfers

- Bill pay

- Automatic savings transfers

- Customer support access

Security and Customer Support

Source: lendedu.com

Synchrony Bank employs robust security measures to protect customer accounts and data. They also provide various customer support channels for assistance.

Security Measures: Security measures typically include encryption, fraud monitoring, and multi-factor authentication. The specific security protocols used are constantly evolving to address emerging threats.

Customer Support Channels: Customer support is usually available through phone, email, and online chat. The availability of these channels and their operating hours may vary.

Reporting Lost or Stolen Cards: If your debit card associated with your savings account is lost or stolen, you should immediately contact Synchrony Bank’s customer support to report it and cancel the card to prevent unauthorized transactions.

Frequently Asked Questions (FAQs):

- Q: What happens if I exceed my account’s transaction limit? A: Synchrony Bank will likely notify you and may impose fees or temporarily restrict access.

- Q: How do I report suspicious activity on my account? A: Contact Synchrony Bank’s customer support immediately.

- Q: What security measures does Synchrony Bank use to protect my data? A: Synchrony Bank utilizes encryption, fraud monitoring, and multi-factor authentication, among other measures.

Eligibility and Requirements

Certain eligibility criteria must be met to open a Synchrony Bank savings account. These requirements ensure compliance with regulations and protect both the bank and the customer.

Eligibility Criteria: Generally, you must be of legal age (typically 18 years or older) and a resident of the United States. Specific requirements might vary depending on the account type.

Minimum Deposit Requirements: Synchrony Bank may require a minimum deposit to open and/or maintain a savings account. This minimum deposit amount can vary depending on the account type. Check the official website for the most current information.

Minors and Joint Accounts: Opening an account as a minor might require a parent or guardian to act as a co-applicant. Joint accounts typically require both account holders to meet the eligibility criteria.

Account Opening Process Flowchart (Illustrative): A flowchart would visually depict the steps involved in opening a Synchrony Bank savings account, showing potential branching points based on eligibility and documentation. For example, a branch might show the path for a successful application versus one where further documentation is required or the application is rejected.

Illustrative Example: A New Customer’s Experience

Imagine Sarah, a 25-year-old, wanting to open a Synchrony Bank savings account online. She visits the Synchrony Bank website, locates the savings account application, and fills out the form with her personal information, including her name, address, Social Security number, and date of birth. She uploads a copy of her driver’s license for verification. After completing the application, she receives a confirmation email and can then fund her account via electronic transfer.

The online banking platform is user-friendly, with clear instructions and a visually appealing interface. The information is presented in a logical sequence, making the account creation process simple and intuitive. During the process, Sarah encounters no challenges and successfully opens her account. The entire process took approximately 15-20 minutes.

Final Wrap-Up

So, there you have it – opening a Synchrony Bank savings account is easier than you think. Forget the intimidating paperwork and long lines. With a few simple clicks (or taps!), you can be on your way to building a brighter financial future. Remember, every little bit helps, and a high-yield savings account is a fantastic way to watch your money grow.

Don’t just dream of financial security – make it a reality. Open your account today and start your journey towards a more financially comfortable tomorrow. Now go forth and conquer your savings goals!